Alibaba Groupi aktsiaid (BABA) ostes ei osta sa tegelikult Alibaba aktsiaid. Kui sa ostad BABA tickeriga aktsiat NYSE börsilt, on see ADR (sellest lähemalt allpool).

Kui aga ostad Alibabat Hong Kongi börsilt (HK:9988), ostad tegelikult aktsiaid Kaimanisaartel registreeritud ettevõttes Alibaba Group Holding Limited.

Kummalgi juhul ei osta sa reaalselt osalust Hiinas tegutsevates Alibaba ettevõtetes. Mida see täpsemalt tähendab? Vaatame lähemalt.*

Mainitud lingid:

- The China Hustle dokumentaalfilm kahtlastest Hiina ettevõtetest USA börsil

Mis on ADR (American Depositary Receipt)?

ADR on lihtsam võimalus USAst väljaspool tegutsevate ettevõtete osaluste müümiseks USAs. Hästi lihtsalt seletades ostab mingi USA pank välismaal konkreetse ettevõtte aktsiaid ja väljastab seejärel USAs selle ettevõtte ADRi.

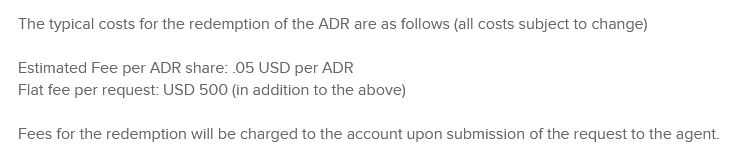

BABA ADRi sponsor on Citibank, kes võtab selle tegevuse eest ka väikest tasu. Antud juhul peaks see olema $0.02 iga aktsia kohta aastas.

See ADR annab sulle õiguse Kaimanisaartel registreeritud Alibaba Group Holding Limited aktsiatele. See aga ei ole Hiinas tegutsev Alibaba, vaid eraldi loodud SPV. See SPV kasutab sellist asja, nagu VIE.**

Mida annab sulle VIE (Variable Interest Entity)?

Põhimõtteliselt on tegemist skeemiga, mis aitab mööda saada Hiina regulatsioonidest, mis piiravad välisinvestorite õigusi Hiina aktsiaid omada. See tähendab, et:

- Sa ei osta osalust Hiinas asuvates Alibaba ettevõtetes.

- Sinu osalus on SPVs, mis omab Hiinas asuva Alibabaga lepingut.

- Selle lepinguga määratakse ära kasumijaotused jms tingimused. Lühidalt, sa ei oma Alibaba ärisid, vaid saad lepinguga õiguse nende kasumile.

- Tüüpiliselt puudub sul VIE kaudu investeerides hääleõigus, aga BABA puhul tundub see siiski eksisteerivat (kuigi juhatusega võrreldes vähendatud mahus).

- Kuna sul pole Hiinas asuvas ettevõttes osalust, siis sul pole ilmselt ka õigust selle varadele, kui ettevõte peaks pankrotistuma või likvideerimisele minema.

Teoreetiliselt on BABA puhul kasutusel ka call optsioonid, mis annavad justkui õiguse Hiinas asuvad ettevõtted omandada. Praktikas aga ei tohi Hiina seadustest lähtuvalt välisinvestorid neid osalusi omandada, nii et see tundub üsna väärtusetu optsioon olevat.

Potentsiaalsed probleemid VIE kaudu investeerides

Mustema stsenaariumi korral võib Hiina otsustada, et see skeem on illegaalne (mida ta ongi) ja need lepingud tühistatakse ära. Samamoodi on raske uskuda, et investoritel õnnestuks selle lepingu täitmist juriidiliselt nõuda, kui Hiinas asuv ettevõte otsustab oma kasumeid mitte jagada.

Vastuargumendina olgu öeldud, et esimene VIE võeti kasutusele juba 20 aastat tagasi ja enamikega ei ole selle aja jooksul probleeme olnud. Küll aga on näiteks Mingsheng bank ja Gigamedia juhtumid näidanud, et kui probleeme tekib, siis investorid oma õigusi kaitsta ei suuda.

China’s supreme court has ruled that its economic rights to these Minsheng Bank shares are invalid. According to the final verdict, the VIE contracts were “concealing illegal intentions with a lawful form”.

Hiina ülemkohtu otsus Chinachem VIE kaudu omandatud osaluse kohta Mingsheng pangas.

Ehk kuigi Hiina kommunistlik partei üldiselt laseb asjal toimida, siis me ei tea, millise ettevõtte puhul nad võivad tulevikus otsustada, et seda enam ei lubata.

Näiteks otsustas Hiina hiljuti üleöö, et haridussektoris tegutsevad ettevõtted peavad edaspidi olema mittetulunduslikud (investeeringud lasti rentslist alla), visata äpi App Store’st välja (SoftBank kaotas Didiga $4 miljardit).

Veidi vähem musta stsenaariumi korral võib BABA mõne haru oma ettevõttest eraldada ja sedasi investorid kasumist ilma jätta (sa ei oma seda ettevõtet).

Varasemalt on näiteks Alibaba seda viimast teinud ja 2011. aastal AliPay (hilisem Ant Group) eraldi keha alla liigutanud. Varasemad investorid Yahoo ja SoftBank said päris valusalt pihta. Kusjuures nad investeerisid samuti läbi VIE struktuuri ja Yahoo omas 43% sellest.

Delistmine (NYSE: BABA)

Kõige selle taustal on juba pikemat aega õhus ka arutelud, et BABA võidakse koos teiste Hiina aktsiatega USA börsilt välja visata. Põhjuseks siis asjaolu, et Hiina aktsiad ei vasta samadele raamatupidamise standarditele, mis USAs kehtivad või USA järelevalvel puudub nende audititele ligipääs.

Meil pole tegelikkuses vähimatki aimu, kas konkreetse Hiina ettevõtte raamatupidamislikud numbrid vastavad tegelikkusele või on tegemist järgmise Luckin’ Coffee juhtumiga. (Soovitan Hiina ettevõtete pettuste osas vaadata seda dokumentaali.)

Kui aga börsinimekirjast välja heitmine peakski reaalselt juhtuma (see juhtuks kõige varem mitme aasta pärast), siis tõenäoliselt saad börsiväliselt (OTC) edasi kaubelda ka peale seda või vahetada need Hong Kongis kaupleva Alibaba aktsiate vastu. Hetkeseisuga tähendab see siis iga 1 (BABA) aktsia kohta 8 (HK:9988) aktsiat.

Kas ka läbi mõne kohaliku maakleri see võimalik saab olema, seda on raske öelda. Natukene tundub kaheldav.

Selle riski vältimiseks võid muidugi kohe Hong Kongi või Frankfurti börsilt osta. Kuigi, kui USAs peaks see aktsia delistimisele minema, siis saab hind tõenäoliselt valusalt pihta, olenemata, mis turult sa seda ostsid.

Kokkuvõtteks

Nii Alibaba kui ka teiste Hiina ettevõtetega seoses on omajagu riske, millest tasub teadlik olla. Ühest küljest VIE struktuuriga seotud riske ja teisest küljest riigikorrast tulenevaid riske. Muuhulgas on näiteks Alibaba osas olnud kuulujutte, et Hiina Kommunistlik Partei plaanib seda koguni ära riigistada.

See aga ei tähenda automaatselt, et tegemist oleks halva investeeringu või spekulatsiooniga. Tuntud investorid, nagu Mohnish Pabrai, Charlie Munger ja Ray Dalio on BABAt veel üsna hiljuti omale juurde soetanud.

Oluline on neid riske teadvustada ja arvesse võtta, kui oma otsuseid langetad. Kui tunned, et riski-tulu suhe on sinu jaoks mõistlik, siis võivad need riskid olla hoopis hea võimalus soodsamalt investeeringusse saada.

Muidugi teadmisega, et kui need peaksid realiseeruma, siis võib sind oodata halvimal juhul ka 100% kaotus.

Kuidas sulle tundub, kas need riskid on seda väärt või hoiad pigem Hiina aktsiatest suure kaarega eemale?

PS! Suure tõenäosusega on nii mõnigi Hiina aktsia juba nii või naa sinu portfellis läbi indeksfondide sees.

Lahtiütleja: Artikli kirjutamise ajal oman pisikest spekulatiivset positsiooni BABAs.

* Kuna minu jaoks on tegemist üsna uue teemaga, siis võimalik, et siin artiklis ei ole kõik info täiesti õige. Kui märkad, et olen millestki valesti aru saanud, siis anna julgelt teada.

**Alibaba juriidiline struktuur on tegelikult tunduvalt mahukam ja keerulisem ja neid ettevõtteid on seal all trobikond. Kui soovid lähemalt uurida, siis kiire internetiotsing on kindlasti abiks.

Kas oled BABA riskide sektsiooniga tutvunud?

Väljavõte Alibaba majandusaasta aruandest, mis antud kontekstis võiks oluline teada olla.

Substantial uncertainties exist with respect to the interpretation and implementation of the PRC Foreign Investment Law and its implementing rules and other regulations and how they may impact the viability of our current corporate structure, business, financial condition and results of operations.

The VIE structure has been adopted by many China-based companies, including us and certain of our equity method investees, to obtain licenses and permits necessary to operate in industries that currently are subject to restrictions on or prohibitions for foreign investment in China. The MOFCOM published a discussion draft of the proposed Foreign Investment Law in January 2015, or the 2015 Draft PRC Foreign Investment Law, according to which, variable interest entities that are controlled via contractual arrangements would be deemed as foreign-invested enterprises, if they are ultimately “controlled” by foreign investors. In March 2019, the National People’s Congress promulgated the 2019 PRC Foreign Investment Law. In December 2019, the PRC State Council promulgated the Implementing Rules of the Foreign Investment Law of the People’s Republic of China, or the Implementing Rules, to further clarify and elaborate upon relevant provisions of the 2019 PRC Foreign Investment Law. The 2019 PRC Foreign Investment Law and the Implementing Rules both became effective on January 1, 2020 and replaced major former laws and regulations governing foreign investment in the PRC. See “Item 4. Information on the Company — B. Business Overview — Regulation — Other Regulations — Regulation of Foreign Investment.” As the 2019 PRC Foreign Investment Law has a catch-all provision that broadly defines “foreign investments” as those made by foreign investors in China through methods as specified in laws, administrative regulations, or as stipulated by the PRC State Council, relevant government authorities may promulgate additional rules and regulations as to the interpretation and implementation of the 2019 PRC Foreign Investment Law. In particular, there can be no assurance that the concept of “control” as reflected in the 2015 Draft PRC Foreign Investment Law, will not be reintroduced, or that the VIE structure adopted by us will not be deemed as a method of foreign investment by other laws, regulations and rules.

Furthermore, on December 19, 2020, the NDRC and MOFCOM promulgated the Foreign Investment Security Review Measures, which took effect on January 18, 2021. Under the Foreign Investment Security Review Measures, investments in military, national defense-related areas or in locations in proximity to military facilities, or investments that would result in acquiring the actual control of assets in certain key sectors, such as critical agricultural products, energy and resources, equipment manufacturing, infrastructure, transport, cultural products and services, IT, Internet products and services, financial services and technology sectors, are required to be approved by designated governmental authorities in advance. Although the term “investment through other means” is not clearly defined under the Foreign Investment Security Review Measures, we cannot rule out the possibility that control through contractual arrangement may be regarded as a form of actual control and therefore require approval from the competent governmental authority. As the Foreign Investment Security Review Measures were recently promulgated, there are great uncertainties with respect to its interpretation and implementation. Accordingly, there are substantial uncertainties as to whether our VIE structure may be deemed as a method of foreign investment in the future. If our VIE structure were to be deemed as a method of foreign investment under any future laws, regulations and rules, and if any of our business operations were to fall under the “negative list” for foreign investment, we would need to take further actions in order to comply with these laws, regulations and rules, which may materially and adversely affect our current corporate structure, business, financial condition and results of operations.

Alibaba SEC aruanded

Our contractual arrangements may not be as effective in providing control over the variable interest entities as direct ownership.

We rely on contractual arrangements with our variable interest entities to operate part of our Internet businesses in China and other businesses in which foreign investment is restricted or prohibited. For a description of these contractual arrangements, see “Item 4. Information on the Company — C. Organizational Structure — Contractual Arrangements among Our Wholly-Owned Entities, Variable Interest Entities and the Variable Interest Entity Equity Holders.” These contractual arrangements may not be as effective as direct ownership in providing us with control over our variable interest entities.

If we had direct ownership of the variable interest entities, we would be able to exercise our rights as an equity holder directly to effect changes in the boards of directors of those entities, which could effect changes at the management and operational level. Under our contractual arrangements, we may not be able to directly change the members of the boards of directors of these entities and would have to rely on the variable interest entities and the variable interest entity equity holders to perform their obligations in order to exercise our control over the variable interest entities. The variable interest entity equity holders may have conflicts of interest with us or our shareholders, and they may not act in our best interests or may not perform their obligations under these contracts. Pursuant to the call options, we may replace the equity holders of the variable interest entities at any time pursuant to the contractual arrangements. However, if any equity holder is uncooperative in the replacement of the equity holders or there is any dispute relating to these contracts that remains unresolved, we will have to enforce our rights under the contractual arrangements through the operations of PRC law and arbitral or judicial agencies, which may be costly and time-consuming and will be subject to uncertainties in the PRC legal system. See “— Any failure by our variable interest entities or their equity holders to perform their obligations under the contractual arrangements would have a material adverse effect on our business, financial condition and results of operations.” Consequently, the contractual arrangements may not be as effective in ensuring our control over the relevant portion of our business operations as direct ownership.

Alibaba SEC aruanded

Any failure by our variable interest entities or their equity holders to perform their obligations under the contractual arrangements would have a material adverse effect on our business, financial condition and results of operations.

If our variable interest entities or their equity holders fail to perform their respective obligations under the contractual arrangements, we may have to incur substantial costs and expend additional resources to enforce the arrangements. Although we have entered into call option agreements in relation to each variable interest entity, which provide that we may exercise an option to acquire, or nominate a person to acquire, ownership of the equity in that entity or, in some cases, its assets, to the extent permitted by applicable PRC laws, rules and regulations, the exercise of these call options is subject to the review and approval of the relevant PRC governmental authorities. We have also entered into equity pledge agreements with the equity holders with respect to each variable interest entity, including the general partners and limited partners of the PRC limited partnerships that indirectly hold our variable interest entities pursuant to the VIE Structure Enhancement, to secure certain obligations of the variable interest entity or its equity holders to us under the contractual arrangements. In addition, the enforcement of these agreements through arbitral or judicial agencies, if any, may be costly and time-consuming and will be subject to uncertainties in the PRC legal system. Moreover, our remedies under the equity pledge agreements are primarily intended to help us collect debts owed to us by the variable interest entities or the variable interest entity equity holders under the contractual arrangements and may not help us in acquiring the assets or equity of the variable interest entities.

In addition, with respect to the variable interest entities that are directly owned by individuals, although the terms of the contractual arrangements provide that they will be binding on the successors of the variable interest entity equity holders, as those successors are not a party to the agreements, it is uncertain whether the successors in case of the death, bankruptcy or divorce of a variable interest entity equity holder will be subject to or will be willing to honor the obligations of the variable interest entity equity holder under the contractual arrangements. If the relevant variable interest entity or its equity holder (or its successor), as applicable, fails to transfer the shares of the variable interest entity according to the respective call option agreement or equity pledge agreement, we would need to enforce our rights under the call option agreement or equity pledge agreement, which may be costly and time-consuming and may not be successful.

The contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration or court proceedings in China. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. Uncertainties regarding the interpretation and enforcement of the relevant PRC laws and regulations could limit our ability to enforce the contractual arrangements. Under PRC law, if the losing parties fail to carry out the arbitration awards or court judgments within a prescribed time limit, the prevailing parties may only enforce the arbitration awards or court judgments in PRC courts, which would require additional expense and delay. In the event we are unable to enforce the contractual arrangements, we may not be able to exert effective control over the variable interest entities, and our ability to conduct our business, as well as our financial condition and results of operations, may be materially and adversely affected.

Alibaba SEC aruanded

6 replies on “Alibaba (BABA; HK:9988) Hiina aktsiad, VIE ja ADR”

Väga kasulik postitus, aitäh!

Kas ma saan õigesti aru, et Frankfurti tickerit ostes saan õige asja või ikkagi SPV?

Kaspar

Mitte ühelgi juhul ei saa sa reaalset osalust Hiina ettevõttes. Hiina seadused ei luba seda. Frankfurdi aktsiat pole lähemalt uurinud, aga selle nimi on Alibaba Group (ADR), tickeriga AHLA. Sellest tulenevalt pakun, et saad sisuliselt samasuguse ADRi, mis BABA.

Ok, Alibabat otse osta ei saa. Mis Alibaba on aga näiteks Swedbanga Robur fondis, nimetusega

Alibaba Group Holding Ltd Ordinary Shares?

https://www.swedbank.ee/private/investor/funds/allFunds/list/details

Eks pead täpsemalt Swedbankilt küsima, mis börsilt ja millist väärtpaberit see seal konkreetselt esindab. Nime järgi ütleks, et sama asi.

VIE struktuurile võimalik põnts pandud jälle. Väidetavalt olemasolevaid ei plaanita keelama hakata, aga uusi IPOsid vist väga oodata ei maksa sellisel kujul. Didi tuleb vist ka kuulduste järgi USA börsilt maha võtta partei korraldusega.

https://finance.yahoo.com/news/china-plans-ban-loophole-used-073233461.html

Rohkem infot ja mõtteid samal teemal:

https://seekingalpha.com/amp/article/4472982-alibaba-baba-stock-worth-delisting-risk